February 25, 2026

The U.S. Federal Reserve’s preferred inflation gauge showed that prices rose at the fastest pace in nearly a year. The Personal Consumption Expenditures Price Index release showed that inflation rose in December at an annual rate of 2.9%—the highest since March 2024. Fresh AI disruption worries sparked a slide following a research report highlighting potential risks to various industries, while software shares reversed back lower with the sell-off spilling into private credit markets again.

Topics of the Week:

International Tilt: A greater emphasis on U.S. large‑company “value” stocks (companies priced reasonably relative to earnings) and developed international markets provides broader drivers of return, not just a narrow slice of the market.

Diversification with a Purpose: Real assets (like commodities and infrastructure) and select alternative strategies are coming to light to help manage inflation and reduce big swings, not just for the sake of owning what’s fashionable.

What We Are Watching:

- U.S. large-cap growth stocks narrowed their year-to-date performance deficit relative to their value counterparts, as a growth equity benchmark outperformed a value index.

- Yields of U.S. government bonds rose modestly but remained well below a recent peak reached a couple of weeks earlier. The yield of the 10-year U.S. Treasury finished the week around 4.08%, up from the year-to-date low of 4.05% at the end of the previous week.

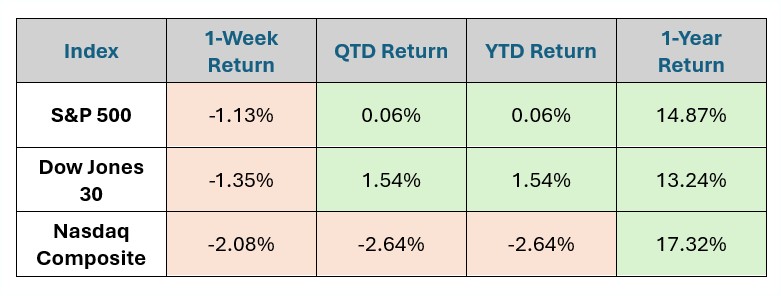

Index Data & Market Performance

Data as of Market Close 2.23.25

source: gemini.google.com*

In Focus

The market is focused on high-stakes inflation data and a busy corporate earnings slate. The most critical release is Friday’s Producer Price Index (PPI), which serves as a major test for inflation sentiment following recent Supreme Court rulings on tariffs.

Tuesday – Consumer Confidence

Wednesday – New Home Sales. Nvidia (NVDA) earnings results are expected after the market close; this is considered the week's biggest test for the AI sector.

Thursday – Initial Jobless Claims, Durable Goods Orders

Friday - Producer Price Index (PPI) (Jan): Expected to rise 0.3% month-over-month.

What's Trending

Eight Quick Takeaways from the Supreme Court’s Tariff Ruling

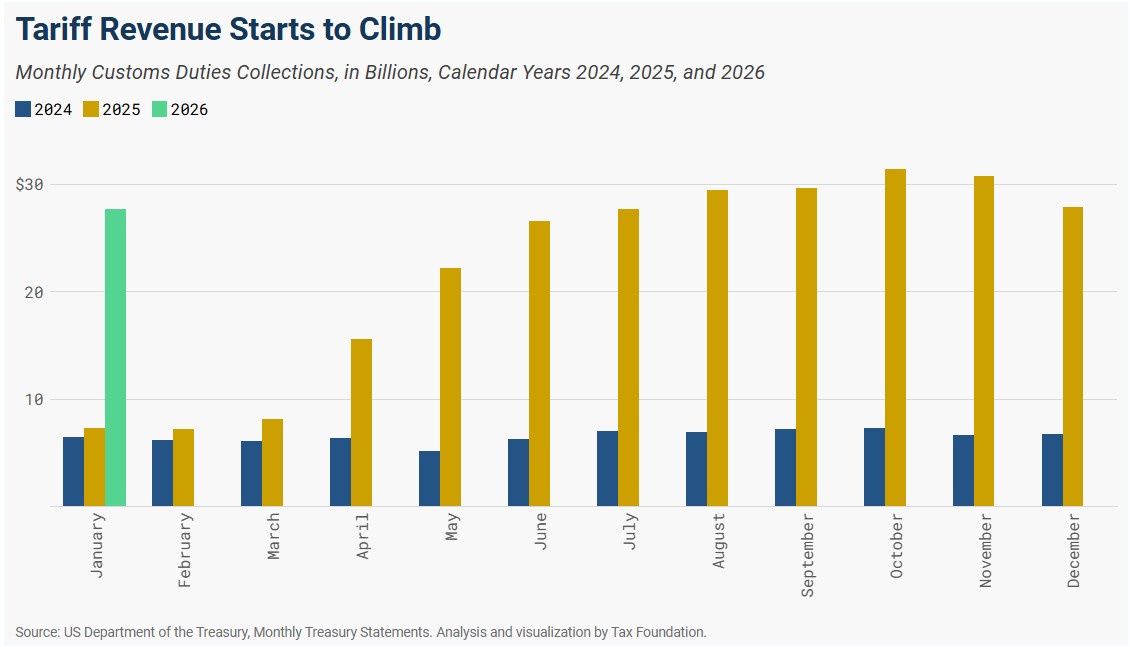

On February 20, the U.S. Supreme Court ruled that the Trump administration’s tariffs issued under the International Emergency Economic Powers Act (IEEPA) are illegal. The ruling invalidates a big component of President Trump’s sweeping tariff program, including reciprocal tariffs and drug-related tariffs on Canada, China, and Mexico.

Here are some of our key takeaways:

- Short-term stimulus jolt. Though mostly expected, the U.S. economy, key U.S. trading partners, and corporate America just found out they are getting a short-term stimulus boost. IEEPA had been used for an estimated roughly half of the tariffs imposed by the Trump administration. While the precise amounts are unclear, countries and companies will now play less.

- Intermediate-term effects are likely to be minimal. President Trump already revealed his tariff pivot to Section 122, which allows for 15% tariffs for 150 days. We believe most of the IEEPA tariffs can be replaced by summertime.

- Trade policy uncertainty remains. While companies paying smaller tariffs is positive for profit margins and the Supreme Court ruling offers more clarity on the future path of tariffs, a lot of uncertainty remains. Markets will continue to debate whether lower courts will force the Treasury to issue refunds. In addition, it’s not clear what this decision means for trade negotiations.

- Inflation impact is murky. If tariffs have not affected inflation much on the way in, then it follows that they won’t affect prices much coming out.

- Don’t expect Fed rate cut expectations to move much. Tariffs were expected to raise input costs, tighten profit margins, and weigh a bit on economic growth. This changes the balance of risks around the Fed’s rate path and may lead to some modest repricing of rate cut expectations and incremental U.S. dollar weakness.

- We would fade the stock market bounce in tariff losers. Given tariffs are already in the process of coming back in with President Trump’s announcement of a new 10% global tariff, we wouldn’t chase any rebounds in import-heavy consumer retailers. It appears the market is onboard with this assessment.

- Treasury may face additional short-term funding pressure. With less tariff income, the Treasury may need to increase issuance modestly, particularly in bills and shorter-dated notes, to offset the lost cash flow. This could put upward pressure on yields at the margin, especially in an environment where supply and demand dynamics were already being tested.

- Refunds may introduce more near-term financing needs. Another key implication stems from the prospect of tariff refunds. Because the Court found the tariffs unlawful, many importers may now file refund claims, potentially up to $175 billion.

|

Sources:

https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

https://www.jhinvestments.com/weekly-market-recap#market-moving-news

Disclosures

*The data for the total returns of the S&P 500, Dow Jones 30, and NASDAQ Composite are compiled and published by several financial news outlets, index providers, and government/academic sources.

Based on typical financial data providers and the search results, here are the likely sources for this data:

- S&P Dow Jones Indices (S&P Global): This is the official index calculator for the S&P 500 and the Dow Jones Industrial Average (DJIA). They publish index data, including total returns, in daily, weekly, and monthly reports/commentary.

- Nasdaq Global Indexes: They are the official index calculator for the NASDAQ Composite. They also publish fact sheets and performance reports with total return data.

- Financial News Agencies and Publications: News outlets like The Associated Press (AP) and financial publications like Investopedia regularly report on the daily, weekly, and year-to-date (YTD) returns of these major U.S. indexes.

- Federal Reserve Economic Data (FRED) / St. Louis Fed: FRED, maintained by the Federal Reserve Bank of St. Louis, is a public resource that often includes daily closing levels for indices like the S&P 500, which can be used to calculate returns.

- Financial Data Platforms (e.g., Bloomberg, YCharts, MSCI): Professional and commercial financial data providers often republish or calculate returns based on the official index data for their clients.