Features & Benefits | Investment Advisory Relationship | Transactional (Brokerage) Advisory |

Financial Planning Services by a CFP® Professional |

| |

Proactive Advice and Planning |

| |

Custom Portfolios designed by our investment team |

| |

Discretionary Investment Management by our investment team |

| |

Risk Management Strategies |

| |

Tax Planning |

| |

Retirement Planning |

| |

Estate Planning Services |

| |

Business Planning Strategies |

| |

Asset Protection & Lifetime Income Strategies |

| |

Charitable Planning |

| |

Gifting Strategies |

| |

Goal Planning (Home Purchase, College Funding) |

| |

Gold Standard CSM |

| |

Periodic Portfolio Rebalancing |

| |

Ongoing Review Meetings |

| |

Annual Advisory Management Cost |

| |

Access to Financial Planning Software |

| |

Specialized Events |

| |

Access to Resources, Tools & Research |

|

|

Cash, Banking & Lending Solutions |

|

|

Community Involvement |

|

|

Educational Seminars & Engaging Webinars |

|

|

Weekly Market Watch Newsletter |

|

|

Individual Buy/Sell Transaction Costs |

|

|

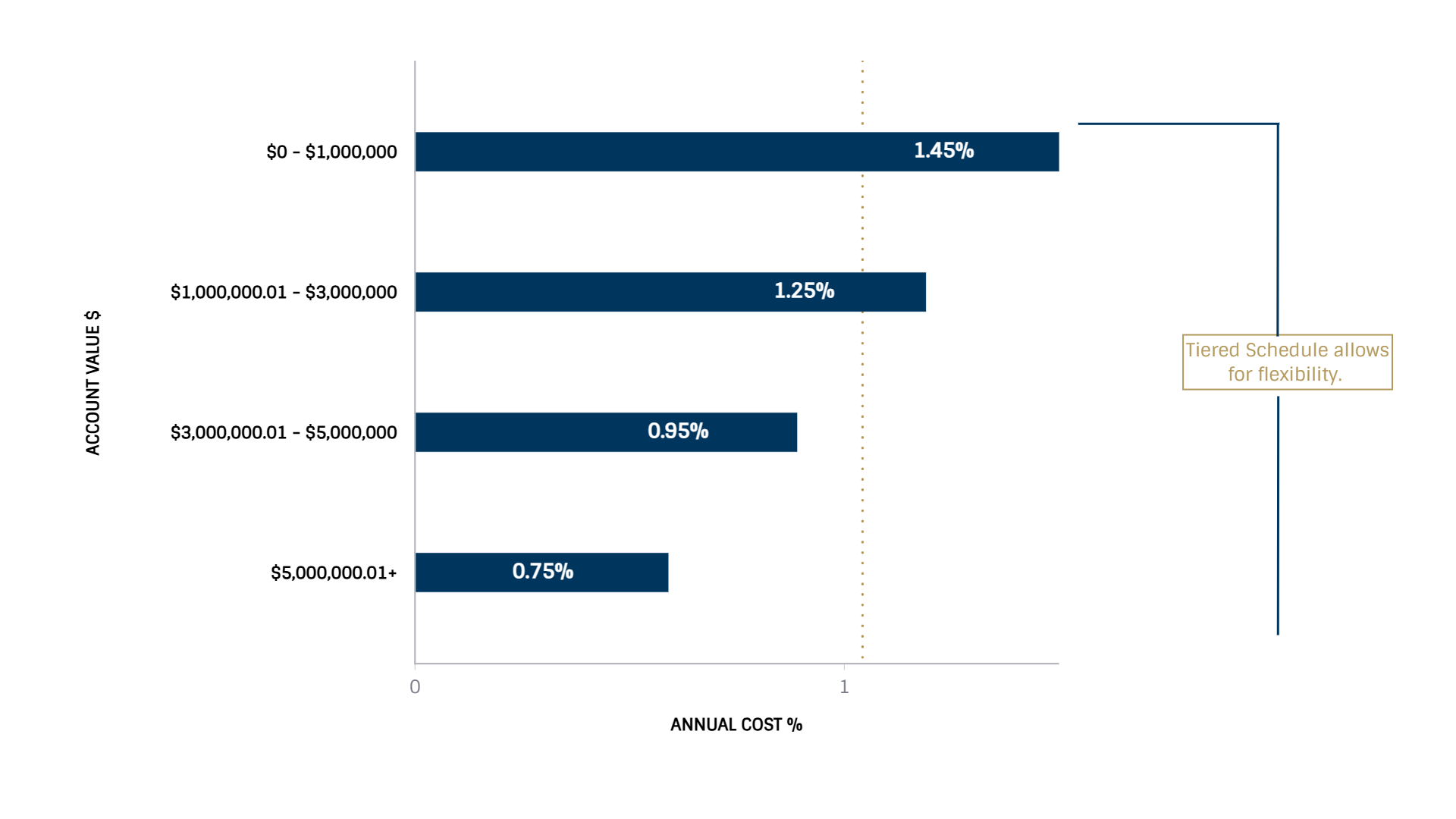

Tiered Advisory Cost

At JWM, our mission is to optimize your financial life and add value to your situation so you can profit from our advice. Ideally, we're paying for ourselves in the process. Examples of such optimization are; increased alpha (additional portfolio returns, risk-adjusted), tax efficiencies, debt restructuring, strategic use of capital, and other planning and investment strategies.

Our compensation is based on an annual advisory management cost. We use a tiered cost structure where the annual management cost declines as the account size increases (see chart). This is an all-inclusive benefit; The annual advisory management cost covers comprehensive financial planning by a CFP® professional, comprehensive investment management by our Chief Investment Officer and team of investment professionals, and our gold-standard Client Service Model.