January 28, 2025

This week, the S&P 500 traded modestly higher, receiving a boost from tech shares, which helped support Nasdaq futures a bit more than the equity benchmark. After recent bouts of headline volatility, market attention turned toward the thick of fourth-quarter earnings season as shares of UPS (UPS) and General Motors (GM) rose on strong revenue guidance and profit guidance, respectively. We will be watching to see how markets respond this week as some of the biggest companies report their earnings.

Source: https://www.jhinvestments.com/market-intelligence

Topics of the Week:

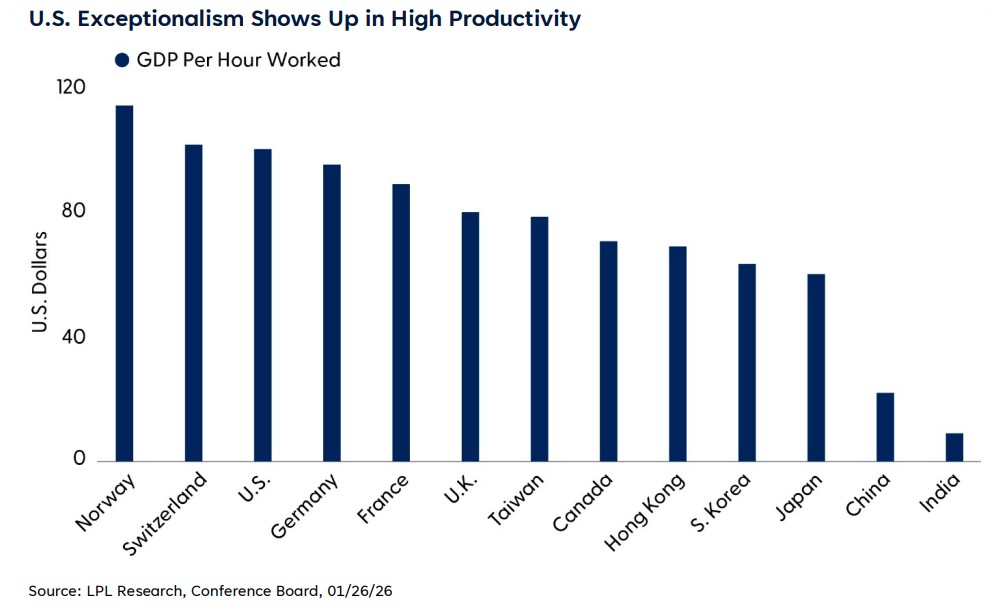

Solid Economic Growth Momentum: Current data suggest the U.S. economy remains on track for above-trend growth in 2026, supported by strong output and improving efficiency.

U.S. Remains Globally Competitive: Compared with other developed economies, the U.S. continues to lead in innovation, technology investment, and productivity, reinforcing long-term economic strength.

What We Are Watching:

Concentration in Service Industries: The economy is increasingly reliant on sectors like healthcare, finance, and real estate, reducing balance across industries.

Market Volatility Risk: Investor optimism is already reflected in asset prices, which may lead to short-term market swings as expectations adjust.

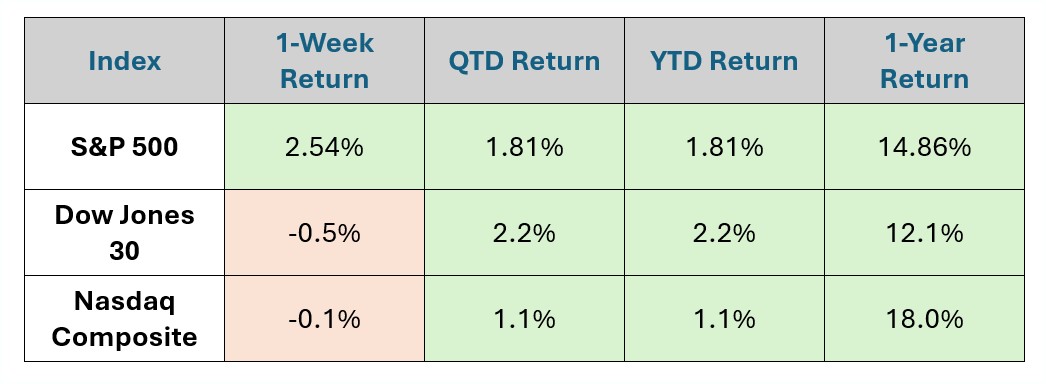

Index Data & Market Performance

Data as of Market Close 1.25.25

source: gemini.google.com*

In Focus

Geopolitical Updates:

Greenland: While the U.S. has reportedly suspended its immediate push to acquire Greenland, the bid has left the NATO alliance in a state of "unprecedented uncertainty".

Tariffs: President Trump unexpectedly increased tariffs on South Korean imports from 15% to 25%, citing delays in ratifying a bilateral trade agreement.

UN: A controversial proposal to replace the UN with a new "Board of Peace" for global conflict resolution has drawn sharp rebukes from China and other world leaders.

Middle East & Iran: Tensions have surged as the U.S. deployed an aircraft carrier "Armada" to the Persian Gulf. Iran has warned of "dire consequences" if attacked, and local internet access remains restricted.

Venezuela: U.S. military and diplomatic actions in Venezuela are significantly reshaping global energy dynamics by attempting to reintegrate the world’s largest oil reserves into the Western-aligned market. By ensuring Venezuelan oil continues to be traded in U.S. dollars, the U.S. is actively reinforcing the dollar's status as the global reserve currency.

The U.S. market is driven by the Federal Reserve's first policy meeting of the year. The Fed's interest rate decision and Chair Powell's press conference on Wednesday are the most anticipated events, with rates widely expected to remain steady in the 3.50% to 3.75% range.

Key Reports

Tuesday – U.S. Consumer Confidence

Wednesday – FOMC Policy Statement & Rate Decision, Tesla, Microsoft

Thursday – Apple

Friday - Producer Price Index (PPI)

What's Trending

Productivity Advantage

Productivity growth is the key mechanism that allows the U.S. economy to expand above its long‑run trend without reigniting inflation. Recent data show U.S. productivity growth surged to 4.9% in Q3 2025, largely because output grew far faster than hours worked. The U.S. remains among the world’s productivity leaders — it ranks near the top of major advanced economies, placing it ahead of Germany, France, the U.K., Japan, and Canada.

The productivity pop also suggests that businesses facing higher labor costs in prior quarters have intensified efforts to improve efficiency, leading to lower unit labor costs (–1.9%) in Q3. Together, these factors explain why productivity jumped so sharply: firms were able to meet demand while relying on smarter production methods rather than expanding payrolls. Stronger U.S. productivity growth can help sustain the economic exceptionalism seen in recent years by reinforcing the nation’s ability to grow even in the face of mounting global and domestic headwinds.

Disclosures

*The data for the total returns of the S&P 500, Dow Jones 30, and NASDAQ Composite are compiled and published by several financial news outlets, index providers, and government/academic sources.

Based on typical financial data providers and the search results, here are the likely sources for this data:

- S&P Dow Jones Indices (S&P Global): This is the official index calculator for the S&P 500 and the Dow Jones Industrial Average (DJIA). They publish index data, including total returns, in daily, weekly, and monthly reports/commentary.

- Nasdaq Global Indexes: They are the official index calculator for the NASDAQ Composite. They also publish fact sheets and performance reports with total return data.

- Financial News Agencies and Publications: News outlets like The Associated Press (AP) and financial publications like Investopedia regularly report on the daily, weekly, and year-to-date (YTD) returns of these major U.S. indexes.

- Federal Reserve Economic Data (FRED) / St. Louis Fed: FRED, maintained by the Federal Reserve Bank of St. Louis, is a public resource that often includes daily closing levels for indices like the S&P 500, which can be used to calculate returns.

- Financial Data Platforms (e.g., Bloomberg, YCharts, MSCI): Professional and commercial financial data providers often republish or calculate returns based on the official index data for their clients.