March 4, 2026

Concerns about the duration of the U.S.-Iran conflict influenced many of the stock market's movements this week, as the closure of the Strait of Hormuz drove oil and gas prices higher. Outside of geopolitics, recent focus on equity market dispersion and the private credit market remained in the headlines, while in earnings, shares of Target (TGT) traded higher on an upbeat forecast. The U.S. dollar index strengthened, breaching the 99-point mark.

Topics of the Week:

The U.S. dollar and precious metals are also likely to be winners during this period of geopolitical uncertainty despite their typical inverse correlation.

The popular defensive equity sector remains healthcare, which is relatively well insulated from rising energy prices and AI disruption risk.

What We Are Watching:

U.S. gasoline prices jumped roughly 11 cents overnight to a national average of $3.11 per gallon.

- The sell-off in U.S. Treasuries has pushed out Fed rate cut expectations as well, with markets now expecting only one full cut in 2026, with a 65% chance of a second one.

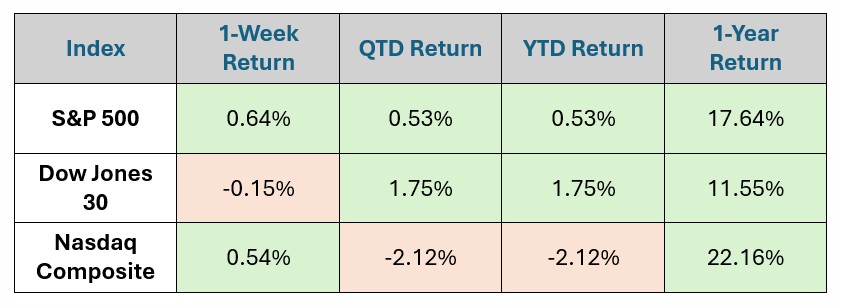

Index Data & Market Performance

Data as of Market Close 3.2.26

source: gemini.google.com*

In Focus

U.S. gasoline prices jumped roughly 11 cents overnight to a national average of $3.11 per gallon.

The sell-off in U.S. Treasuries has pushed out Fed rate cut expectations as well, with markets now expecting only one full cut in 2026, with a 65% chance of a second one.

Tuesday – JOLTS

Wednesday – ADP Employment

Thursday – Weekly Jobless Claims

Friday – Retail Sales

What's Trending

Crude Conflict - Eye on Iran

As you know, there are escalating geopolitical tensions in the Middle East following U.S. and Israeli strikes on Iran. According to reports from the Financial Times, President Trump has said Operation Epic Fury could last for approximately four weeks or less. We are offering up our best and most current thoughts on the situation as we see them. The ongoing concern that deserves our attention is the fluctuation of oil prices.

Let’s talk about oil:

- OPEC+ will add 206K barrels/day in April, slightly easing supply pressure.

- Venezuela can increase output, giving the U.S. another lever to stabilize markets.

- The Strait of Hormuz is the main risk: over 150 tankers are stuck, blocking a route that carries 20% of global oil.

- The U.S. is a net exporter, so it’s less vulnerable to physical shortages.

- A $10/barrel sustained increase typically slows U.S. GDP by 0.10–0.20 percentage points.

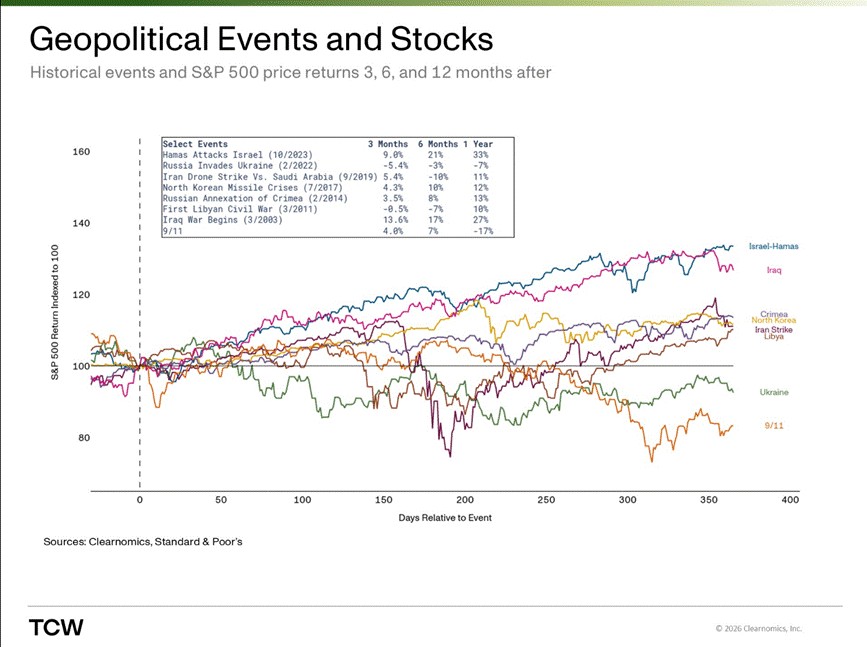

The situation remains fluid. The key is the duration and scope of hostilities. We believe patience is the best strategy given the stock market’s strong track record of resilience through wars and other military conflicts.

This chart shows that geopolitical shocks often trigger short-term volatility, but markets have historically recovered. Across all major conflicts, the S&P 500 has frequently been higher 6–12 months later, even after sharp initial declines. While near-term uncertainty and volatility are likely, diversification and a long-term perspective remain critical during periods of conflict.

|

Sources:

Disclosures

*The data for the total returns of the S&P 500, Dow Jones 30, and NASDAQ Composite are compiled and published by several financial news outlets, index providers, and government/academic sources.

Based on typical financial data providers and the search results, here are the likely sources for this data:

- S&P Dow Jones Indices (S&P Global): This is the official index calculator for the S&P 500 and the Dow Jones Industrial Average (DJIA). They publish index data, including total returns, in daily, weekly, and monthly reports/commentary.

- Nasdaq Global Indexes: They are the official index calculator for the NASDAQ Composite. They also publish fact sheets and performance reports with total return data.

- Financial News Agencies and Publications: News outlets like The Associated Press (AP) and financial publications like Investopedia regularly report on the daily, weekly, and year-to-date (YTD) returns of these major U.S. indexes.

- Federal Reserve Economic Data (FRED) / St. Louis Fed: FRED, maintained by the Federal Reserve Bank of St. Louis, is a public resource that often includes daily closing levels for indices like the S&P 500, which can be used to calculate returns.

- Financial Data Platforms (e.g., Bloomberg, YCharts, MSCI): Professional and commercial financial data providers often republish or calculate returns based on the official index data for their clients.