December 31, 2025: Hot and Cold

Hot and Cold

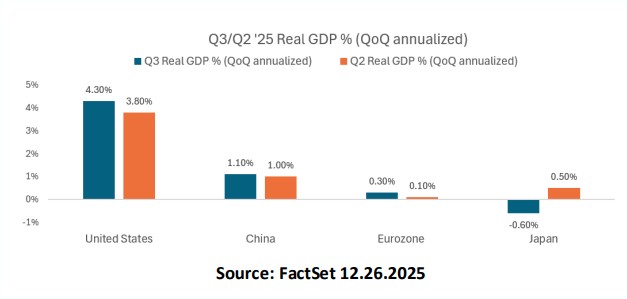

The end-of-year market data, much like the weather here in Denver, can be quite variable, exhibiting both hot and cold trends. U.S. Q3 GDP was hot, but December consumer confidence was cold. U.S. Q3 real GDP is lagged data due to the government shutdown, but it did capture the market's attention. The estimate was for 3.0% quarter-over-quarter annualized growth, but it came in at 4.30%, a massive beat relative to the consensus. The big drivers in U.S. Q3 GDP were likely a productivity boom (as employment growth was modest but GDP still advanced) and a decline in the savings rate as consumers spent into savings.

Highs and Lows

The University of Michigan sentiment survey is near record lows, as the S&P 500 is at record highs, which has rarely happened before (we will whisper “this time is different”). While the overall sentiment reports may not be of value, as consumers say one thing and then do another (spend). Within the consumer confidence report, there are still important job market survey components. One that we focus on is how many people are saying, “Jobs are hard to get.”